Computing, Business and IT Buddy

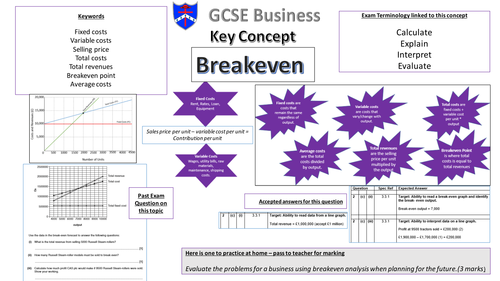

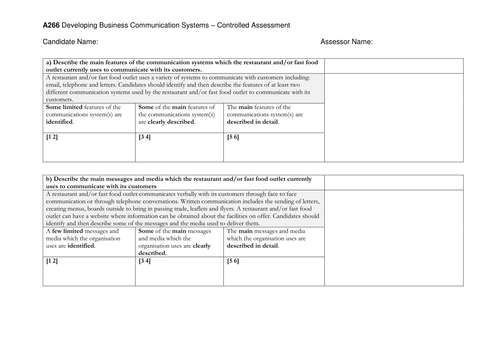

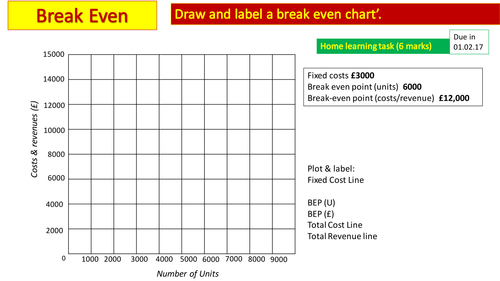

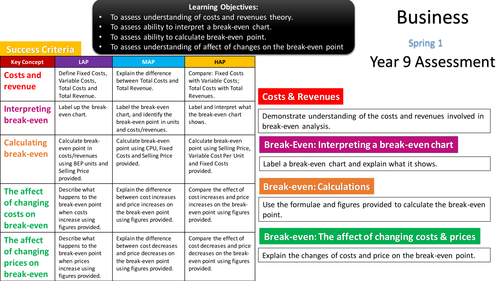

With a few decades of experience teaching Computer Science, Business and IT, this shop has a variety of resources for KS3 Computing as well as the KS4 GCSE Computer Science, GCSE Business, BTEC Business and BTEC TA DIT. More resources coming in the near future.